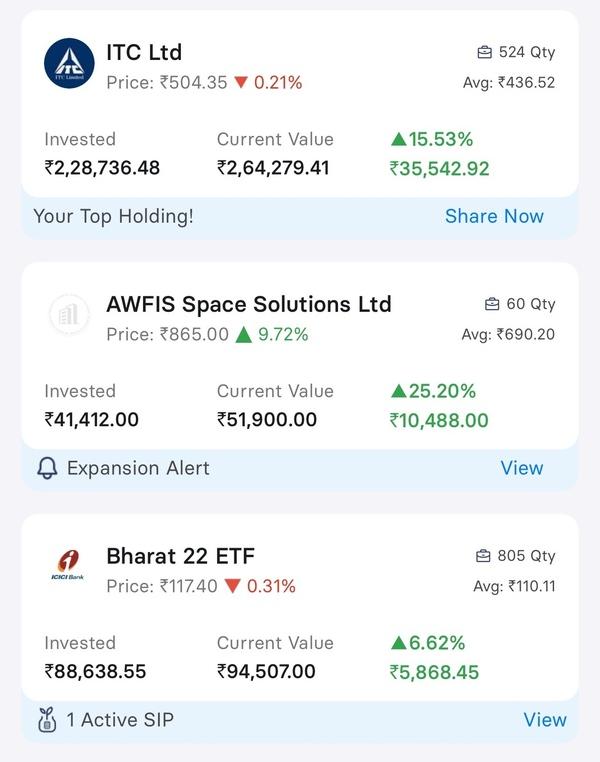

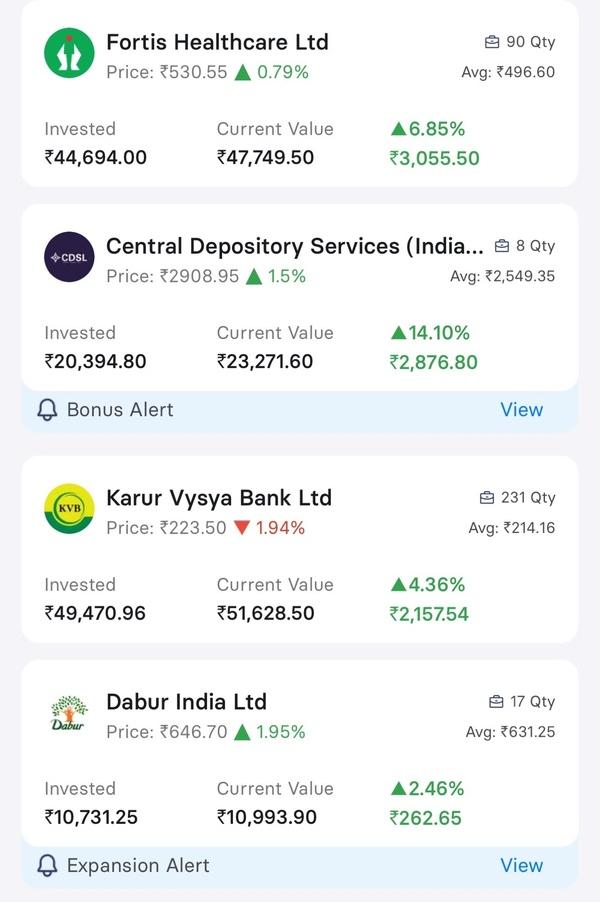

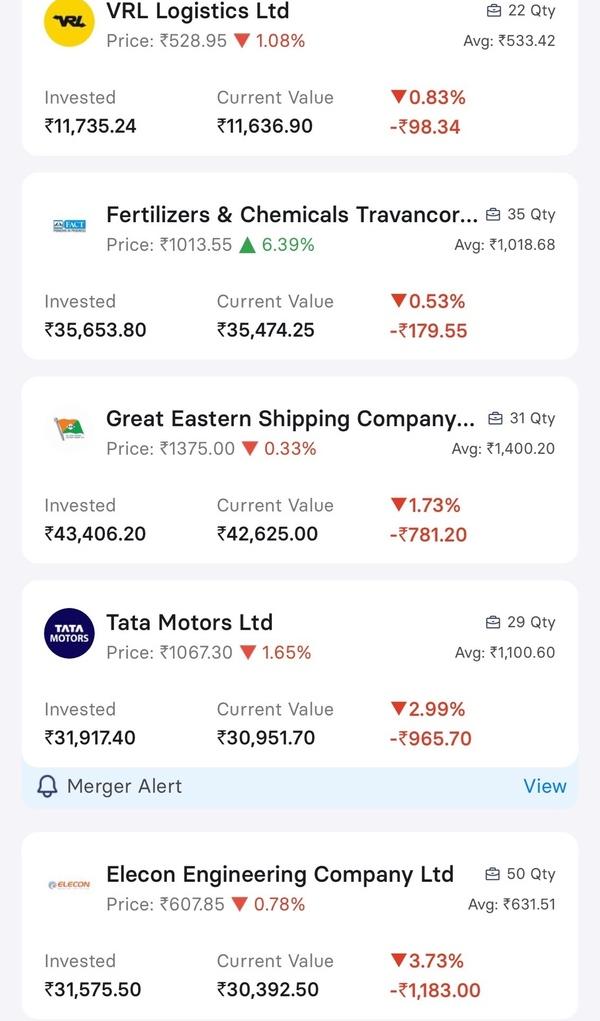

This is my present long term portfolio.

I rebalanced it recently. Booked some profits and invested it in debt. The horizon on these stocks is 2+ years. I use a different broker for shorter duration swing trades (1–6 months).

I’ll quickly throw in a few pointers that I have learnt, picked up and experienced myself.

Kindly go through all details of any stock before any sort of investing/trading. PE ratio, EPS, basics in Balance sheet, recent events and news. All of this so easily available in most apps.

Have a mental picture. Give yourself a percentage in terms of profit and loss, and exit if you’re doing short term trading.

If you have fundamentally researched a stock, and believe in it, don’t panic if it drops. Most new investors panic seeing a red portfolio. Up and downs are part of the business.

Don’t listen to unsolicited tips, buy calls etc. Don’t listen to finfluencers and their calls, instead learn from them, learn the basics.

Don’t be part of FOMO. Numerous stocks were bought by people because everyone was talking about it, and eventually people lost a lot of money in it.

Higher the reward opportunity, higher the stock.

Please stay away from futures and options until you understand it, if you did you wouldn’t be reading this answer.

The best bet is always the Index. Nifty 50, Nifty Next 50 etc. Buy stocks under them or preferably ETFs covering them.

I generally tend to ask myself if I know about this company, have I heard about them and what is their reputation generally before even screening for fundamentals.

Don’t be greedy. 12% annually is a great return. If you’re able to make 3–5% I believe in a month, and preserving capital, you’re winning the game and learning.

Diversify. 20–30% of your capital should be in high risk stocks. Take that bet after through perusal. Rest should be in blue chip and fundamentally strong stocks.

Markets fall, it’s their nature, bull runs don’t last for long. When they fall, don’t panic sell. Also, the reason you shouldn’t invest in any random cheap stock.

Penny stocks are lucrative but they’re useless mostly.

Dividends are amazing. Have some dividend stocks in your portfolio. They will give you stability as well. ITC is a great example.

Don’t start until you have read thoroughly and don’t put all your capital. Start low and slow.

Markets reward people who have patience, and who can escape the greed trap. You won’t become rich overnight, but you will if you hold on.

No comments yet, come on and post~